Value Chain Mapping for Key Products in Lesotho’s Creative Industries

The “Value Chain Mapping for Key Products in Lesotho’s Creative Industries” analyzes the wool and mohair, and basketry artisan value chains in Lesotho. This research developed a plan to transform the artisan sector of Lesotho into a viable industry. The research is based on public data, interviews, focus groups, benchmarking of the craft sectors of neighboring countries, and historical perspectives.

Our research supports women’s economic security and empowerment. The study was undertaken through a partnership with the Millennium Challenge Corporation (MCC), as part of an MCC initiative to promote learning around approaches to advancing women’s economic security and empowerment in its country programs. This partnership was also undertaken to inform the development of MCC’s Compact with the Government of Lesotho (GoL), which will seek to support women entrepreneurs.

Our investigation focused on studying all links in the artisan value chain: the global market potential of wool and mohair, and basketry products; the production capacity of an aging workforce; and the lack of wool and mohair processing facilities in Lesotho. We conducted 395 Key Informant Interviews (KIIs) and meetings to acquire the data needed to draw a value chain map for each sector. The report presents two value chain maps based on the template map in the study “Global Value Chain Analysis: Concepts and Approaches” by the United States International Trade Commission.

This study was made possible by the generous support of the U.S. Government through the Millennium Challenge Corporation (MCC). The contents are the responsibility of Creative Learning and do not necessarily reflect those of the Millennium Challenge Corporation (MCC) or the U.S. Government.

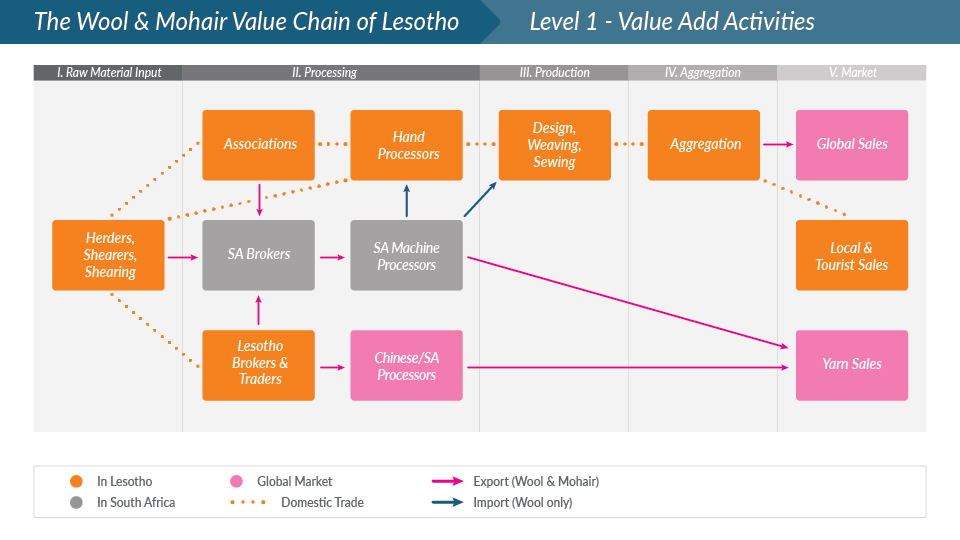

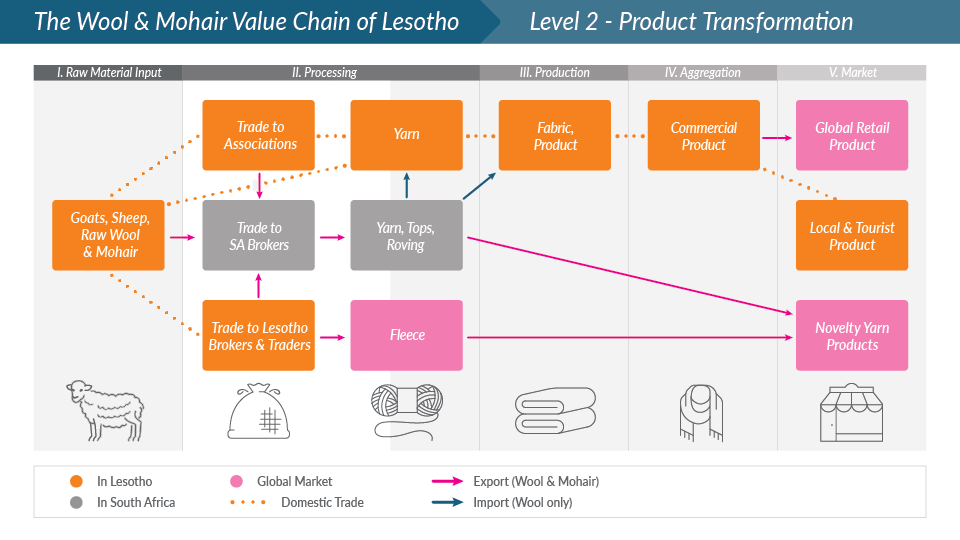

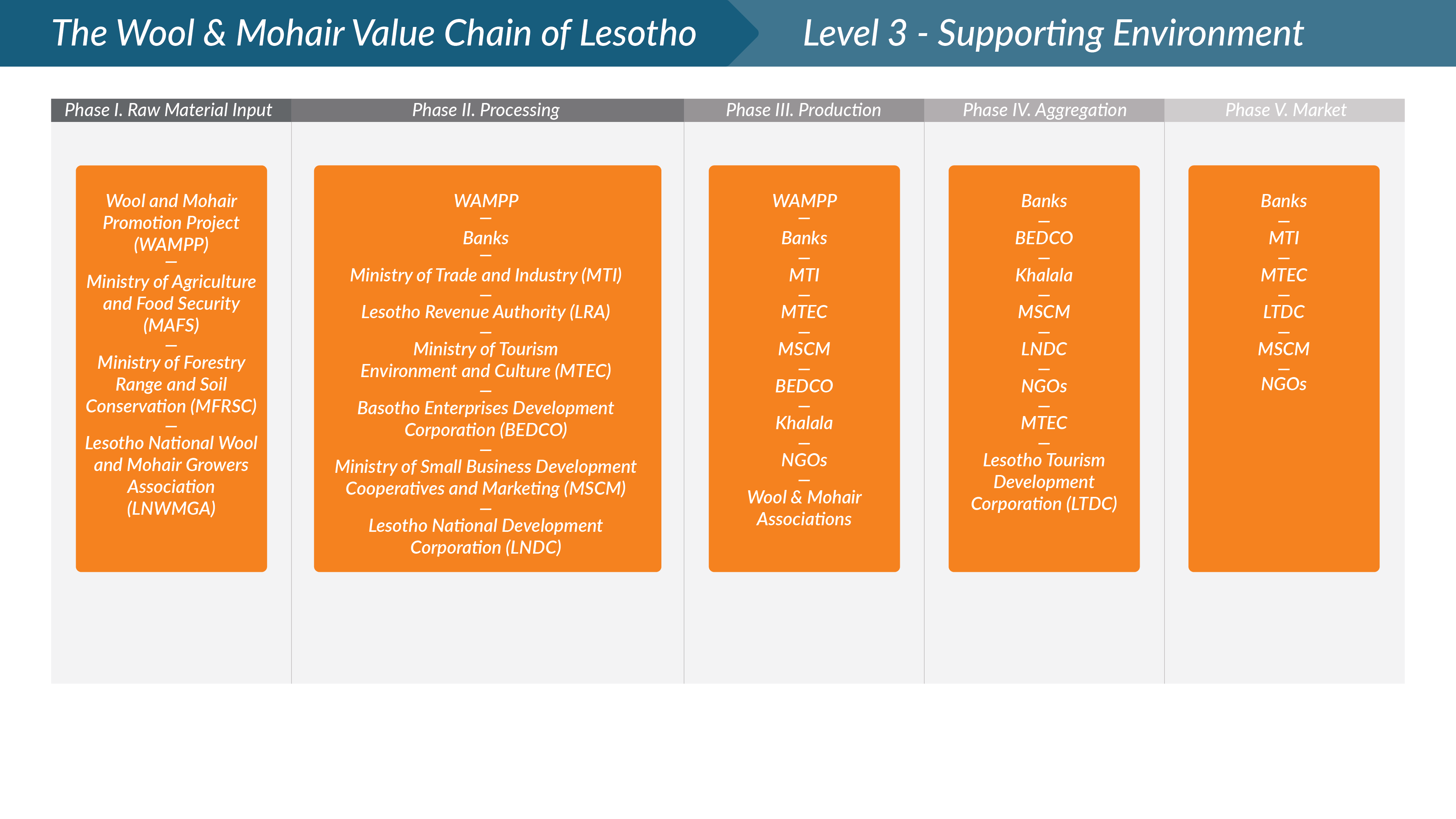

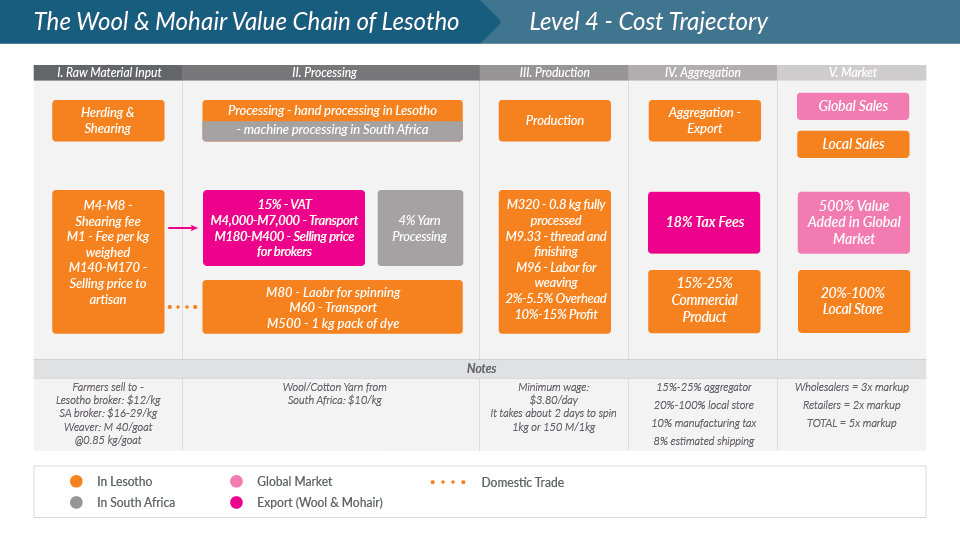

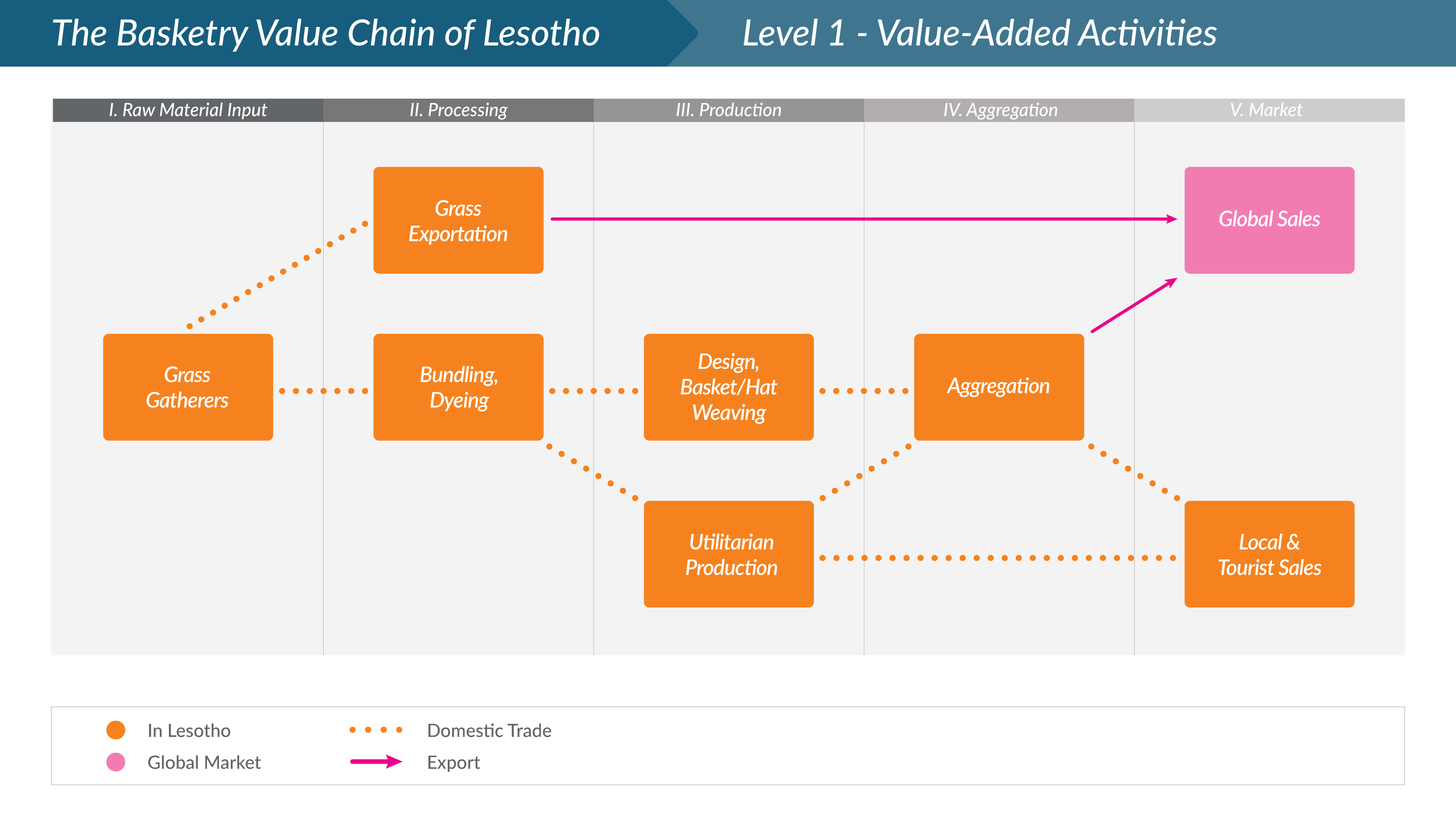

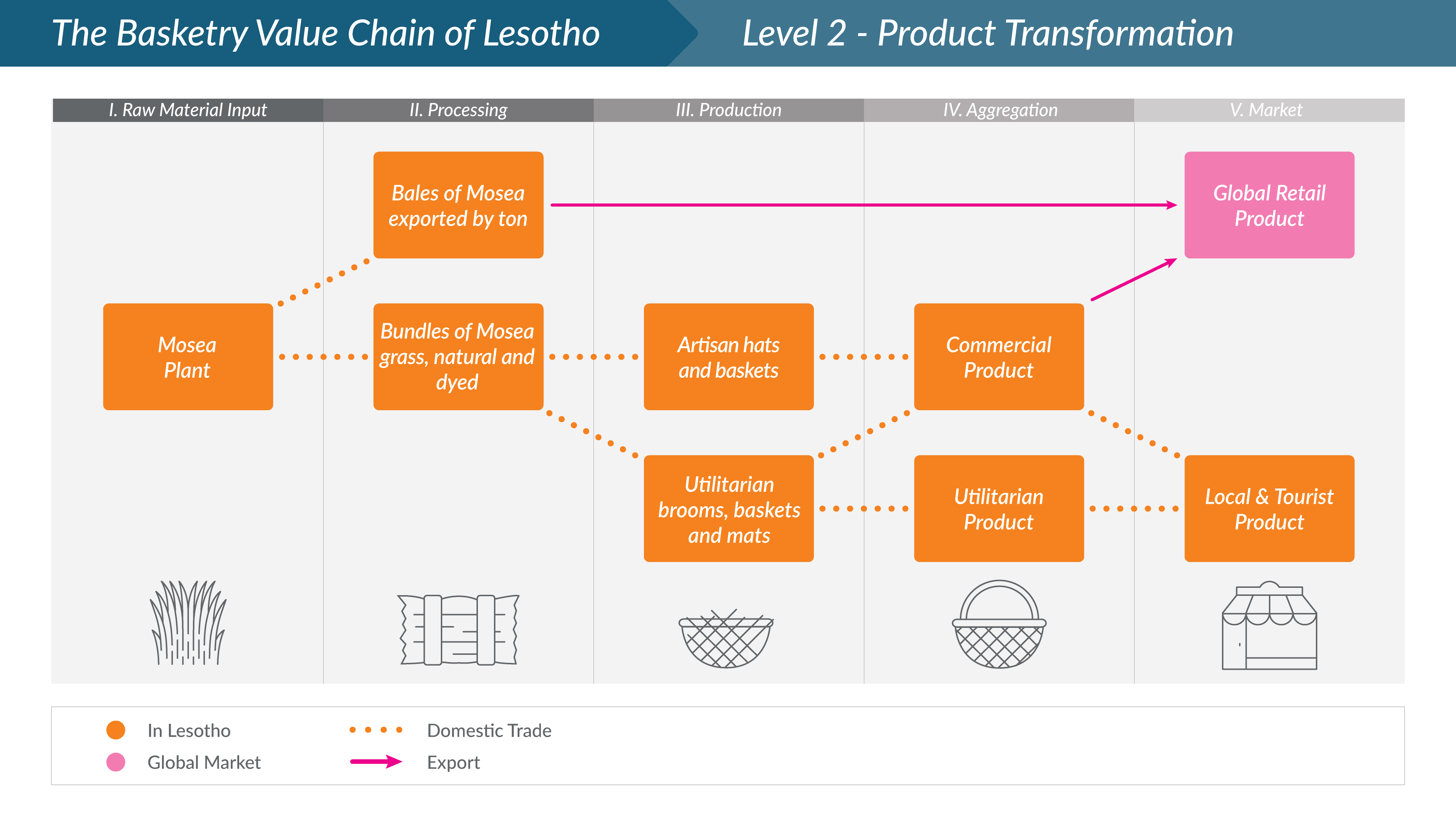

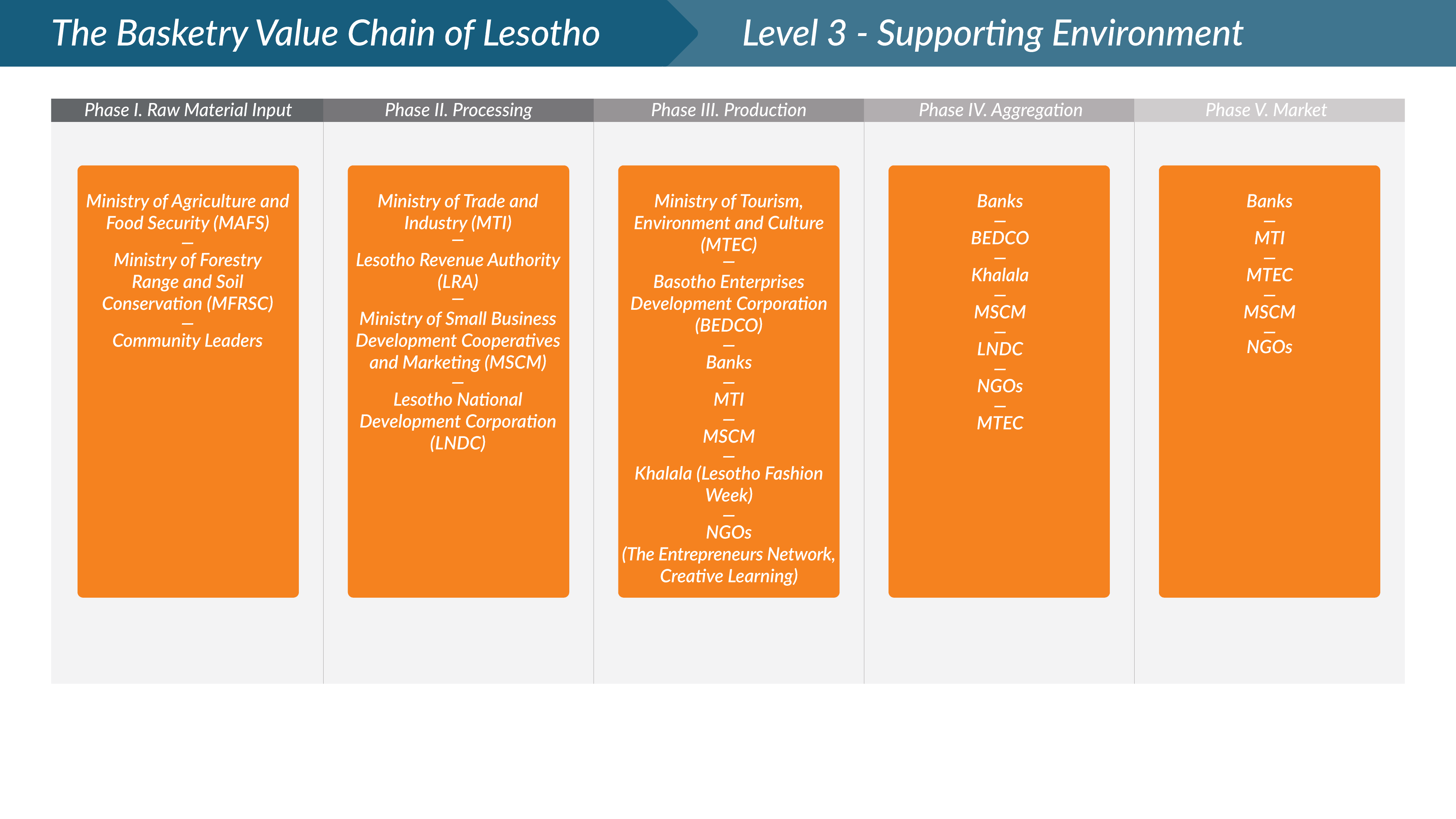

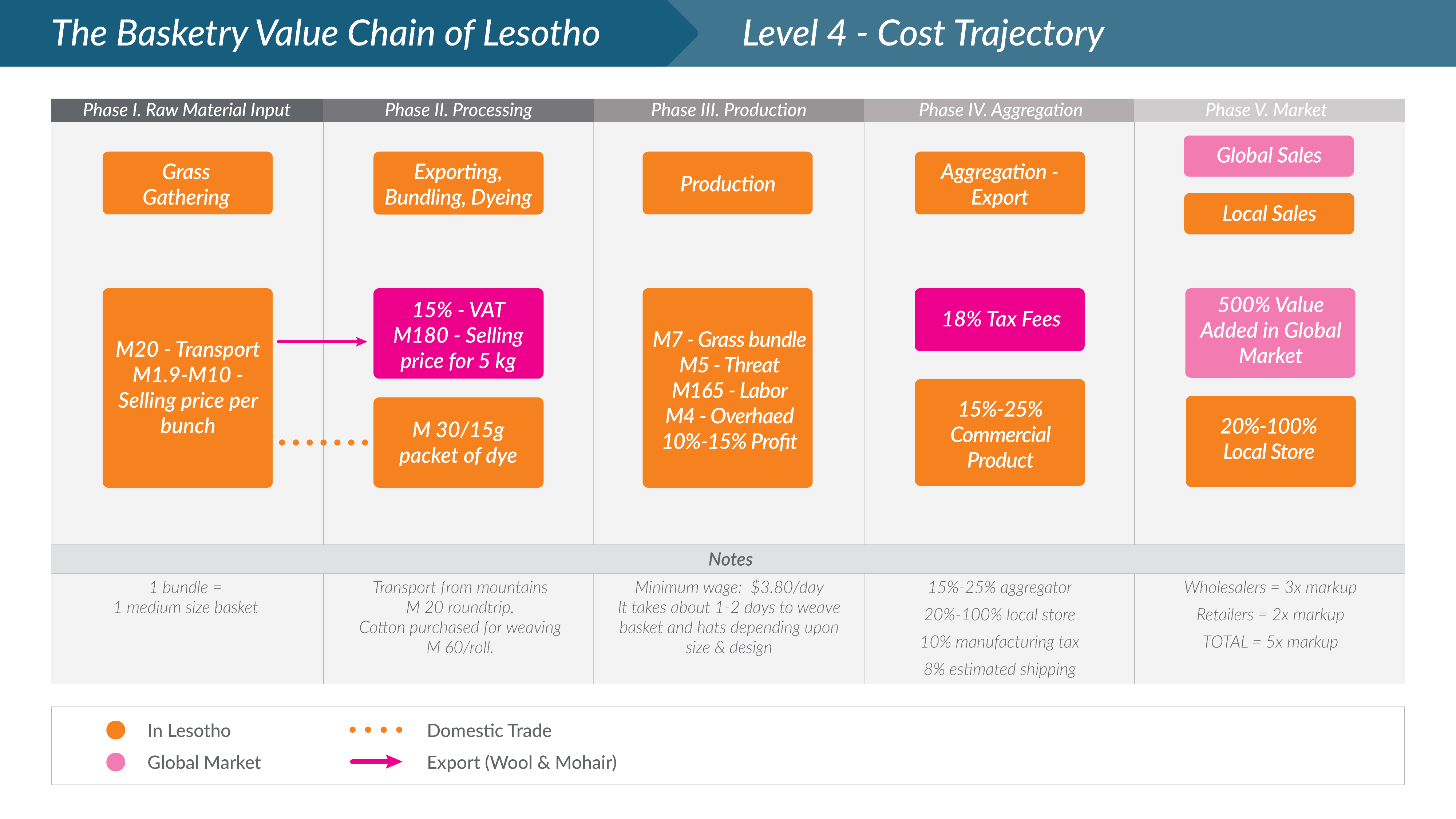

The value chain maps are divided into five phases and four levels for both the Wool and Mohair and Basketry value chains. We detail the actors, their roles, and the impact they have at each phase and level while highlighting gaps and challenges facing each value chain.

Value Chain Phases

Value Chain Levels

To download a full copy of the report, and to learn more about key actors in this report, enter your information on the right. You will receive an email to download the full report and Actor’s Glossary.

Creative Industries Sector Overview

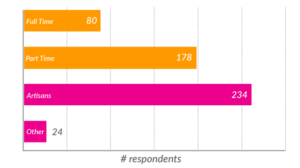

Artisan Respondent Overview

A sample size of 109 (93 artisans + 16 spinners) were interviewed – these interviewees include artisans that work independently and those who are a part of an artisan company. To date, Creative Learning has identified 669 artisans, 556 of which work in the wool and mohair or basketry sector. The remaining work in leather, jewelry, pottery and other. It is important to note that no precise statistic exists for the total number of artisans in Lesotho, however, CL estimates the total artisan population to be less than 1000. The artisan sector consists of both formal and informal actors, the latter of which, often goes unrecognized.

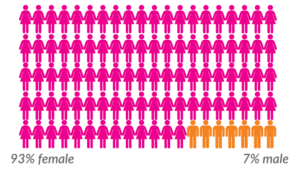

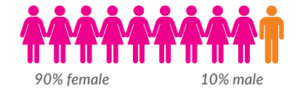

Artisan Respondent Gender

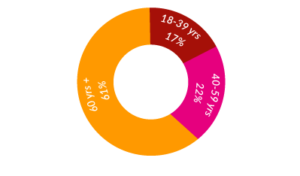

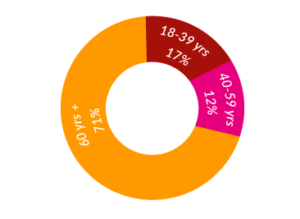

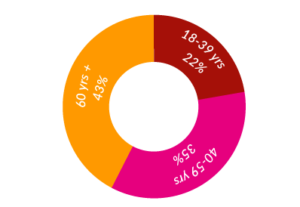

Artisan Respondent Age

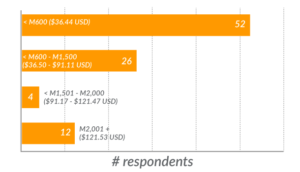

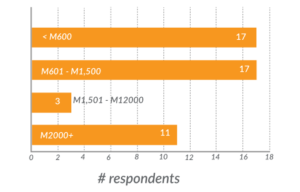

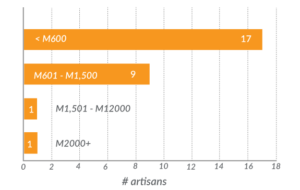

Artisan Respondent Income

Artisan Companies Employee Gender

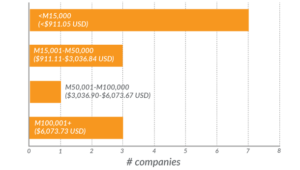

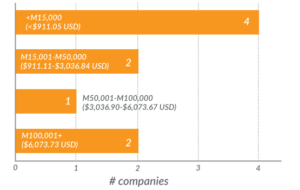

Twenty-two artisan companies in both value chains were interviewed. These 22 companies represent all wool and mohair or basketry companies that are registered or known by the Government of Lesotho (GoL). Only 14 companies had reported their annual revenue.

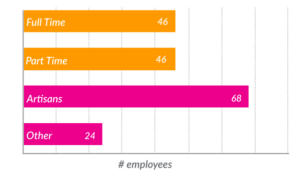

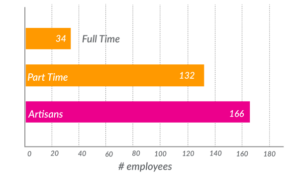

Artisan Companies-Employee Gender

Artisan Companies-Employee Breakdown

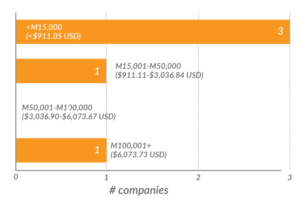

Artisan Companies-Annual Revenue

Designers

Seventeen designers were interviewed. CL has identified 250+ designers who exist in Lesotho. While many designers are also crafters, seven reported that they design for other artisans. Seven of the 17 designers work with wool and mohair, and one designs basketry for fashion accessories. Two designers could not provide monthly income figures. Compared to artisans, designers are less than 39 years old.

Aggregators (Agents & Shops)

Twenty-three aggregators were interviewed, representing 15 agents and shops. Agents represent various artisan companies and help sell the products locally and globally. Gift shops provide access to the local and tourist markets.

The Wool & Mohair Value Chain

Wool and Mohair Sector Structure and Overview

Wool and mohair are key value chains in Lesotho. Wool is the country’s top export, and mohair is the fifth largest. The fibers are raised by smallholder farmers and herders. Fibers are sorted and graded at shearing sheds, associations, local and South African brokers, auctioneers and are finally processed for the global market. Lesotho artisans buy raw fibers through their associations or directly from individual farmers. Fibers are hand spun, woven, knitted, and sewn into finished products. The final products then go through local, regional and international marketing channels.

Wool & Mohair Artisans

48 artisans interviewed

Wool & Mohair Artisan Gender

Wool & Mohair Artisan Age

Wool & Mohair Artisan Income

Wool & Mohair Companies

12 companies interviewed

Wool & Mohair Company-Employee Gender

Wool & Mohair Company-Employee Breakdown

Wool & Mohair Company-Annual Revenue

Wool & Mohair Value Chain Map

The wool and mohair VC in Lesotho is complex. It has 5 phases, many actors, and is subject to political intricacies. Below you will find the full maps.

Click on the buttons below the maps to find an interactive image and more detail for each level of the wool & mohair value chain.

Interactive Wool & Mohair Value Chain Maps

Key Findings

Local Processing Facility

As the GoL shifts wool and mohair brokerage from South Africa to Lesotho, the new processing center, funded by IFAD and implemented by WAMPP and BEDCO, will add significant value. This will provide weavers and designers with access to higher quality mohair at good prices enabling growth at each phase of the value chain.

Investment in Production & Export of Specialty Yarn

Investing in specialty yarn could create significant numbers of jobs in the sector. This investment would result in producing and exporting machine-processed and hand-spun Basotho branded wool and mohair specialty yarn with ‘colours and textures different than monotone wool yarn’.

Upgrade Local Activities for Effective Tracking & Data Management

Local activities, such as land management, shearing, and herding must be upgraded and digitalized for effective tracking and data management to avoid bottlenecks in the value chain.

Brokerage & Processing to be Performed Locally

Brokerage and processing (currently taking place in South Africa) should be done locally to increase job opportunities and rejuvenate the sector.

Increased Access to Technology and Training Will Help to Scale MSMEs

MSMEs need access to technology, entrepreneurship training, incubator programs, marketing skills, and supply management skills for scalability and to employ more people at the production and aggregation phases to increase incomes and attract more investment and youth in the sector.

Increase Financial Investment

Access to finance is a challenge: from the lack of funding to run sustainable programs implementing by the supporting environment actors to the lack of capital for MSMEs to operate efficiently and earn a profit, it is evident that financial investments are vital for the sector’s success and viability.

The Basketry Value Chain

Basketry Sector Structure and Overview

The Basketry Value Chain uses readily available organic raw materials, mountain grass or thatching grass. Hat making is a traditional use of this material and is sold in local markets. The grasses are collected by gatherers and exported by Lesotho exporters for trade or sold by individuals to artisans. Aggregators sell produced baskets and hats in the local, regional and international markets.

CL conducted 365 KIIs interviews and meetings, including direct value chain actors and supporting actors. Data generated in these interviews and meetings is summarized below.

Basketry Artisans

43 artisans interviewed

Basketry Artisan Gender

Basketry Artisan Age

Basketry Artisan Income

Basketry Artisan Companies

10 companies interviewed

Basketry Companies-Employee Gender

Basketry Companies-Employee Breakdown

Basketry Companies-Annual Revenue

Basketry Value Chain Map

In comparison with the wool and mohair VC, the basketry VC is relatively simple. The following is a breakdown of the four levels and five phases in the value chain.

Click on the buttons below the maps to find an interactive image and more detail for each level of the basketry value chain.

Interactive Basketry Value Chain Maps

Key Findings

Improved Market Access

Improved market access for artisan groups would increase income generation across the VC. The raw material remains abundantly available. Local demand for the main product, Basotho hats, continues as it has for decades.

Growth Potential for Decorative Basketry

Growth potential is considerable for with high value-added decorative basketry for upscale lifestyle, gift, and home décor retail chains. According to the Handmade Buyer Survey conducted by CL in partnership with Trade+Impact in December 2020 and January 2021, basketry is a vital buying category to 68% of handmade buyers. Around 55% buy from Sub-Saharan Africa. 31% of international retail and wholesale buyers continue to sell baskets as home décor and storage pieces during Covid-19. We believe there remains significant potential for the Basotho basketry sector to compete in the international market.

Lack of Organization and Production Capacity

Our analysis shows that the lack of organization and production capacity of the basketry artisan groups poses a significant challenge for the sector. Aggregators have to travel to Butha Buthe to collect the finished goods, adding to their costs. Moreover, there is no network or central place for teaching basket weaving to encourage youth and people living with disabilities to join the sector.

Increase Exports of Raw Material

On the processing end of this value chain, there is also potential to increase exports of the raw material, Mosea grass, for producers of utilitarian products such as brooms and mats. Grass exporters can scale up but need to acquire more business and entrepreneurship skills, market access, and investment opportunities. By participating in an incubator program, these MSMEs could improve their services, standardize and digitalize their processes, and create jobs.

Tourism Industry Still Offers Opportunity

The tourism industry has not been thoroughly tapped as a market for the finished products. Eco-lodges and hotels across Lesotho have not used them to decorate their lobbies or hotel rooms as their neighboring countries we studied in the benchmarking analysis.

Transfer of Master Weaver’s Skills

Although the artisans’ skills are strong, master weavers have not been able to transfer these skills to a younger generation.

To download a full copy of the report, and to learn more about key actors in this report, enter your information on the right. You will receive an email to download the full report and Actor’s Glossary.

This study was made possible by the generous support of the U.S. Government through the Millennium Challenge Corporation (MCC). The contents are the responsibility of Creative Learning and do not necessarily reflect those of the Millennium Challenge Corporation (MCC) or the U.S. Government.