2021 Handmade Buyer Research Report

Summary

Handmade is a unique global sector, and it is increasingly recognized by its stakeholders as a value chain appreciated for creating more than just economic impact, but social and environmental impact as well. In fact, buyers and artisan businesses in the sector, in most cases, do not see trade as a transaction but a relationship to each other, to the handmade products, and to the artisan producers and the communities they impact. It is with this in mind that Aid to Artisans (ATA), supported by Trade+Impact (T+I), and Dondrill Glover, a global market consultant, and funded by Millennium Challenge Corporation (MCC) conducted this research study to strengthen the handmade buyer and seller relationship and to better understand the challenges which may be limiting the sector’s growth. While this report focuses on the buyer research completed in 2021, it also references a CMH Artisan Survey conducted in 2020 by Powered by People (PBP) and T+I, funded by Mastercard Foundation, to bring a broader perspective and further highlight gaps and opportunities where they may exist.

Small independent retailers and wholesalers, 80% from North America, make up the majority of the respondents of the study. Key highlights of this report are the importance of impact areas such as “ethically sourced” and “investing in vulnerable artisan communities”, and buyers’ interest in aligning their mission and values with the artisans/sellers they choose to partner with and purchase from. Interestingly, while impact areas are critically important to buyers, fair trade certification ranks considerably lower in importance.

The study revealed that, pre-COVID, buyers were more focused on the home textile, basketry, and home décor categories versus fashion accessories. In contrast, the 2020 CMH Artisan Survey revealed production of fashion accessories as the #1 category for artisans with home textiles and basketry much lower in production ranking. There is an opportunity for artisans to consider the expansion of home décor, textiles, and basketry in their product line to appeal to a wider buyer audience.

Over 85% of buyers ranked the following areas as the most important when working with artisan businesses; quality, meeting lead times, shipping and logistics, and customer service. However, all the areas ranked most important to buyers were met with significant gaps in effectiveness. The overall highest-ranking gaps between importance and effectiveness were customer service, measuring and communicating impact, and supply chain transparency. These gaps highlight potential opportunities for growth and improvement in the sector.

Our research supports women’s economic security and empowerment. The study was undertaken through a partnership with the Millennium Challenge Corporation (MCC), as part of an MCC initiative to promote learning around approaches to advancing women’s economic security and empowerment in its country programs. This partnership was also undertaken to inform the development of MCC’s Compact with the Government of Lesotho (GoL), which will seek to support women entrepreneurs.

This study was made possible by the generous support of the U.S. Government through the Millennium Challenge Corporation (MCC). The contents are the responsibility of Creative Learning, and do not necessarily reflect those of the Millennium Challenge Corporation (MCC) or the U.S. Government.

Access the full 2021 Handmade Buyer Research Report by entering your email on the right. You will receive an email with a link to download the report.

Methodology & Profile

The research was conducted through a 31-question online survey of global artisan/handmade buyers, both wholesale and retail enterprises. The survey was conducted from December 2020 through January 2021 during the time COVID was still impacting the handmade sector. Forty-eight enterprises participated in the study with a full completion rate of over 60%.

Type of Buyer

Location

Annual Revenue (USD)

Key Findings

Buyer behaviour

Product Categories

83% of buyers indicated that home textiles is an important category to them. Basketry and home décor ranked second with 68%, while kitchen and fashion accessories and jewelry tied for third at 57%. In addition, holiday products were important to 50% of buyers.

When comparing to the 2020 CMH Artisan Survey, the #1 category which artisans produced was fashion accessories and jewelry at 46%, while 45% of respondents produced home décor and only 39% home textiles. There is an interesting gap between the buyer interest in textiles/décor and basketry versus the percentage of artisans

producing these products.

Regions

Approximately 55% of respondents purchase from Sub-Saharan Africa, while 48% purchase from Latin America and 45% from Asia, with the large >$1 million USD buyer segment purchasing more from Asia Pacific relative to smaller buyers.

Percentage of Handmade in Merchandising Buy

For the majority of buyers (61%) responding to the survey, handmade products make up over 80% of their purchasing assortment. Handmade products make up a smaller percentage of the purchase assortment for the larger buyer segments.

Trade show goals

In terms of trade shows, exploring new brands is the number one goal for making contacts at trade shows, while artisan resource and building existing brand relationships are the second and third goal. Almost 50% of buyers have a goal of networking at trade shows.

Trends & Customization

66% of respondents believe that keeping up to date on trends to influence buying is important or very important and 78% of respondents use social media as a trend resource for handmade while approximately half use tradeshows as a resource. Only 38% of respondents feel having the option of brand customization or “white label/private label” production is important or very important.

Buyer’s Trade Show Goals

COVID-19 dynamics

Buyer operations during COVID-19

The global crisis has had an impact on buyers’ operations particularly as it relates to supply chain interruptions, e-commerce upgrade (75% of under $50K USD segment invested in e-commerce upgrades) and adjusting business hours.

It is interesting to see how sales channels changed through the crisis; 51% of respondents are still selling through brick and mortar, particularly with the over >$150K buyer segment. However, home delivery is the second highest sales channel for buyers with 46% selling through this channel.

One-third of buyers were selling via curbside pickup and 23% through Facetime/Zoom/Skype virtual selling.

Changes to buyer business because of COVID-19

Buyer sales channel during COVID-19

Trade show review

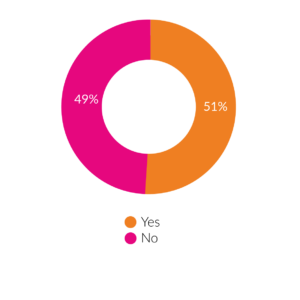

Since COVID-19 started, 51% of respondents have attended virtual trade shows. Those who did not attend indicated they did not see the value as their time and availability was limited. There was also a lack of interest due to decreased sales, though some indicated they intended to attend in the future.

Buyers attended virtual trade shows

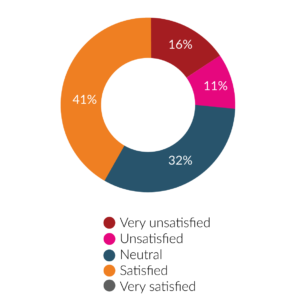

Satisfaction with virtual trade shows

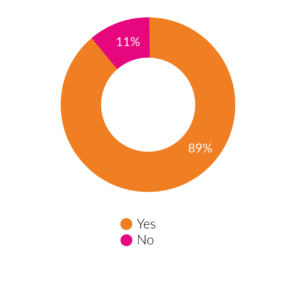

Would attend future virtual trade shows

Travel Review

At the time of the survey, 58% were not comfortable traveling regardless if it was domestic or international travel. As CDC safety guidelines and social distancing solutions emerge for 2021 64% agreed this would influence their decision to travel to trade shows. 71% indicated that attending a physical trade show in 2021 would depend on Covid-19 status.

Deciding factors for working with artisan businesses

Importance of positive impact when working with artisan businesses

The top five factors for buyers when working with artisan businesses are quality, authenticity and uniqueness, aligning with their company values and mission, ethically sourced and investing in vulnerable artisan communities. Environmental sustainability, supporting culture and heritage, and benefiting women artisans also ranked strongly. Story telling is also very important for buyers particularly when considering what is important for their customers.

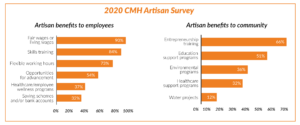

Artisan businesses meet the buyer demand for positive impact

Based on the 2020 CMH Artisan Survey, a high percentage of artisan businesses provide employees with fair wages and skills training as well as providing entrepreneurship and education support programs to their communities. 99% indicated they make an effort to be environmentally friendly in their organization.

Importance & effectiveness of artisan business operations

The most important operational factors to buyers when working with artisans are: quality; meeting lead times; customer service; shipping and logistics; and accurate & complete fulfillment of orders. Each of these criteria were ranked important or very important to over 80% of buyers surveyed.

Buyers were asked how effective artisans were at delivering on these same criteria and the gaps between importance and effectiveness were measured. Significant gaps exist across the top five factors with customer service showing the largest gap with meeting lead times and quality following closely behind. The biggest gaps across all the areas were customer service, measuring and communicating impact, and supply chain transparency with a gap of 32 points between how important buyers considered it to be compared to how well artisans delivered against it. Packaging for export was second highest with a 29 point gap. Meeting lead times, new product development, and quality all followed with over 20 point gaps.

Comparing buyer & artisan perspectives

Interestingly the 2020 CMH Artisan Survey identified where the artisans felt their greatest challenges were; customer service, quality control, and supply chain transparency were only considered a challenge by approximately one third of the artisans and customer service was ranked as the least challenge. Measuring and reporting impact was considered a challenge by approximately 50% of artisans.

These comparable findings seem to indicate a disconnect between what buyers see as a challenge when working with artisan businesses and how the businesses see it, specifically as it relates to quality, customer service, and supply chain transparency. Meeting lead times was not included in the artisan survey however production planning and operations could be considered related to this criteria, where there also seems to be a gap between buyer and artisan business perceptions.

3 Key Learnings & Recommendations

1. Importance of impact

Learning

The findings of both the buyer survey and the 2020 CMH Artisan Survey indicate that creating positive impact is very important to both stakeholder groups: both stakeholders agree there is a gap/challenge in measuring and reporting against impact.

Recommendations

Artisan businesses have an opportunity to be very clear on the positive impact that they are having. However, all will not be the same as there are often unique ways that individual businesses can impact their employees and communities and environment. Regardless, there should be a consistent approach:

- Identify the impact

- Measure the quantitative impact each year. This may include the number of training courses, the number of women supported to start savings accounts, financial investment into the community, percentage of sustainable materials used in products and there are many other potential measures.

- Communicate the impact – on your website, in your newsletter, to your customers, through storytelling

Buyers have the opportunity to request this information from the artisan businesses and provide support where possible in helping to identify relevant and appropriate quantitative indicators along with suggestions how best to communicate the information.

2. New category opportunities

Learning

Home décor, textiles and basketry all ranked as highly important categories for buyers, in addition holiday products were important to 50% of buyers.

Recommendations

Artisan businesses have an opportunity to consider expanding their product line if

- It is a natural expansion from your current product line: same raw materials could be used

- There is interest from your buyers for these products: consider surveying a few of your key buyers for input

- You do not require significant capital investment to make the shift

Buyers can discuss the opportunity to expand product lines with the artisans to support them in identifying potential opportunities to grow through a new product line.

3. Operational improvements

Learning

Significant gaps exist between what is important to buyers when working with Artisans and how effectively buyers believe these areas are delivered against. Most notably:

- Customer service

- Quality

- Meeting lead times

- Packaging for export

- Measuring and communicating impact

- New product development

- Supply chain transparency

Recommendations

Artisan businesses did not see many of these as a challenge (e.g. Customer Service, Quality Control, Supply Chain Transparency, Production Planning and Operations.) Given that buyers in general are not satisfied in these areas, there is an opportunity for artisan businesses to take a closer look at their operation and evaluate where there are challenges from their buyers’ perspectives and undertake a plan to improve in the areas which are most relevant to those buyers.

Buyers have the opportunity to clearly communicate with their suppliers where they are not satisfied and open a dialogue to support improvement in these areas.

Final Recommendations

It is hoped this report will be used as a tool for artisan enterprises to make strategic decisions for their businesses. When considering how to improve the business for 2022, we recommend that you identify one or two areas from this report and create an action plan for improvement with the action, timeline and responsibility identified.

What’s Next?

Artisan businesses have an opportunity to develop new products that meet market demand, improve their relationships with buyers, and better understand the market through the resources at Artisan Business Lab. Artisan Business Lab is a platform powered by Aid to Artisans that offers a more direct way to accelerate growth by providing artisan businesses with in-depth self-paced courses, one-on-one coaching, webinars, downloadable tools, networking events, and our semi-annual live training event known as the eMarket Readiness Program. Course offerings such as Artisan Product Development and Design give non-designers the tools to create a new product line that meets market demands. Artisan Business Marketing is a self-paced course that offers the essential tools you need to keep your business in motion in the market. Artisan Branding is a self-paced course that walks you though the creation of your own brand book and guide to define and refine the right look, feel and tone for your business that will speak to your ideal clients.

All these tools and more are available on artisanbusinesslab.org.

The handmade sector is on a precipice; global consumer demand is high and artisan skills abound, particularly in marginalized economies across Africa and globally. However, the sector lacks key dynamics such as investment, technology, and standardization to scale effectively across the value chain. Trade+Impact believes transformative change in this sector is only possible through strong partnerships, a shared vision, a heart-centred approach and a will to drive change.

The Handmade Futures Initiative, HFI embodies this. In 2022, T+I is convening a holistic and diverse group of stakeholders to proactively identify, prioritize and address the systemic issues that limit the future growth and scalability of the sector grounded by an inclusive, heart-centred approach. If you are interested in participating in HFI please contact info@tradeplusimpact.org.

Access the full 2021 Handmade Buyer Research Report by entering your email on the right. You will receive an email with a link to download the report.

Our research supports women’s economic security and empowerment. The study was undertaken through a partnership with the Millennium Challenge Corporation (MCC), as part of an MCC initiative to promote learning around approaches to advancing women’s economic security and empowerment in its country programs. This partnership was also undertaken to inform the development of MCC’s Compact with the Government of Lesotho (GoL), which will seek to support women entrepreneurs.

This study was made possible by the generous support of the U.S. Government through the Millennium Challenge Corporation (MCC). The contents are the responsibility of Creative Learning, and do not necessarily reflect those of the Millennium Challenge Corporation (MCC) or the U.S. Government.